Topics:

Ivella

I want to start with a small confession, speaking as someone who works in the financial services sector, investing into financial services startups: I think that finances are super boring and I truly believe that one of the structural failings of human civilisation to date is the continued attention that everyday people have to pay to money just to get by. With that in mind, let me tell you about one of my favourite new startups Ivella – one of the latest investments we’ve made here at Anthemis:

I first spoke with Kahlil Lalji, CEO of Ivella, in March 2020. It was three days after the UK had just gone into pandemic lockdown, so naturally, things were all over the place, but I remember the conversation being lucid and open. The problem that the company was going after was clear, and in my mind unsolved: how can two people in love manage their money together? We’d seen a few companies try to tackle the couples’ finance, but much of it was backward-looking summaries of expenditure, the type of thing you could pore over with your partner, but nothing related to the moment of spend itself, and nothing that solved the emotional pain that can sometimes come when talking about money in relationships. In fact, at the time, there wasn’t even a standalone joint account neobank in the market.

They weren’t raising, so we dropped out of touch and most of a global pandemic passed by. The second time we spoke, Kahlil had a brand new approach to couples’ finance to show me: the Split Account. I have to say, I really think they’ve cracked it.

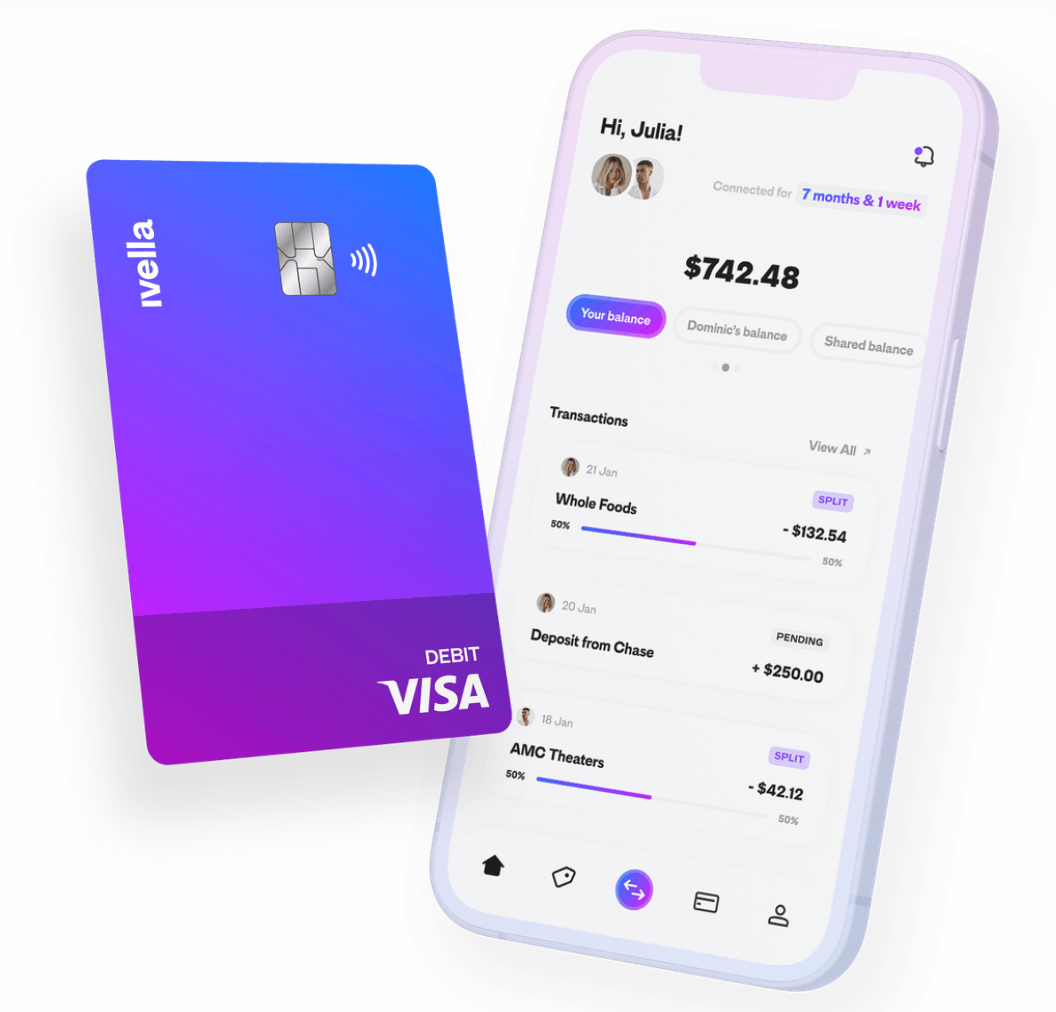

Ivella has built pure financial automation magic for committed relationships. With the Split Account, each person in the relationship is given their own card and their own balance. Then, whenever either spends money, the expense is split between both balances in line with a fully customised ratio set by the couple, no end-of-the-month reconciliation required. Whatever your ratio: 50/50, one-thirds-two-thirds, split-by-salary, Ivella can handle it. Spent something on there that you shouldn’t have? No worries, you can set a custom ratio for each spend retroactively, too. Just need to transfer dollars between partners? Covered.

The important thing about the Split Account is it simply makes tedious and relationship-straining financial admin disappear. As I said earlier, the fact that society has pushed couples into spending precious time thinking and talking about financial reconciliation and pinging money back and forth to make each other good for this or that expenditure is just sad. Ivella is the cure.

Built for the modern relationship, Ivella makes onboarding and offboarding super simple. This is important, and a key difference from a joint account. Users sign up independently, and only after they’re up and running do they associate their accounts with each other and set up how they want to split expenses. In the case of a breakup, users can simply unattach their accounts without having to messily chase down those last few owed dollars.

It’s not just the financial engineering that’s elegant though – I highly encourage you to check out the app and website. Kahlil and team take design incredibly seriously. Any interaction you might have inside the app has been worked and re-worked until it’s perfect, the colour palette has been meticulously plotted out, and there are little flourishes that make the app a joy to use.

What Kahlil, Eric, and Vishal started here is something truly special that makes the world a better, more loving place. I’m so pleased to announce Anthemis’s seed investment into the company I spoke to all that time ago!

—

If you’re suffering from Venmo and Cash App in your relationship, head over to Ivella and get signed up! Also, if you’re a talented individual and any of this resonated, Ivella are hiring. Go check out their website or drop them a line by email.