Topics:

Stable

Call me old fashioned, but I’ve always loved agriculture…or, specifically, agtech: infrared webcams affixed to tractors to assess crop health, computerised farm-fishing, IoT smart sticks for soil monitoring and genomic sequencing to understand animal health and yield. I love being outside. I love to eat. I want to invest in an industry that represents both a fragile natural ecosystem and our greatest hope for stabilising humanity.

Sadly, most farmers today are under-insured. The World Bank and World Food Programme estimate the insurance gap for farmers to be $1 trillion worldwide. And farmers are not the only ones exposed to fluctuating commodities prices. Less than 10% of the world’s commodities are not traded on any exchange, so for most farmers and food buyers, hedging is simply not possible.

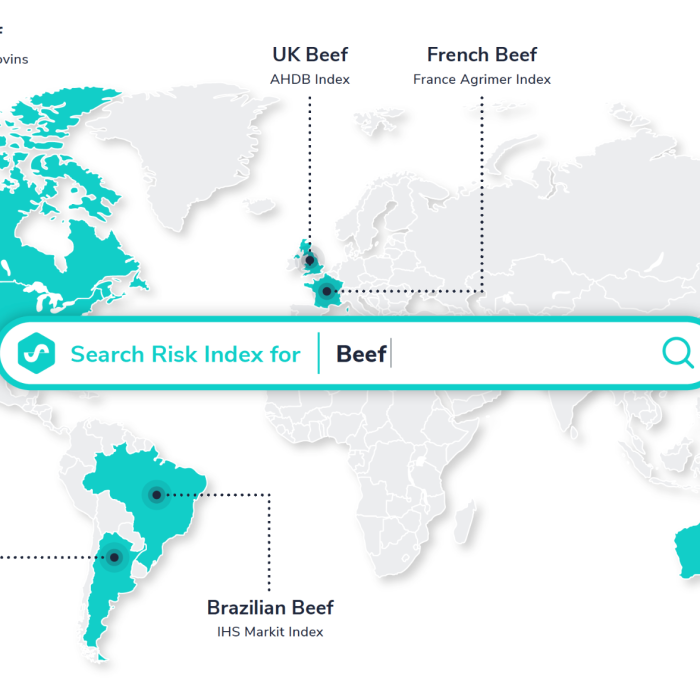

Enter Stable. Richard Counsell, Stable’s CEO, farmer’s son and former commodities man, who looked at the lack of access and availability to derivative-based hedging tools and saw an opportunity. If reliable indices exist, he thought, then surely there must be a way to price the risk and build a diversified portfolio for risk capital providers across hundreds of previously inaccessible commodities.

Stable is bringing a fresh perspective to food security, one of the most important issues facing our society. Sitting at the intersection of agriculture, finance and technology, the team is offering an easy-to-use product for any business with exposure to commodities risk. As investors, we are pleased to back Richard and his team as they tackle this multi-trillion-dollar opportunity.

Purchasing price insurance products with Stable is as easy as buying car insurance. All contracts are underwritten by global underwriters and risk capital providers.

Stable allows users around the world to protect their local risks, in their local currencies. Corporate clients can use the dashboard to protect and manage their entire risk management portfolios in one place.

Clients get more certainty, become more credit-worthy and can invest in the future with confidence, leading to improved operational efficiency.

How have Richard and the team delivered this novel solution? Stable’s data scientists analysed and extensively tested thousands of scenarios on hundreds of indices to calculate risk of loss probabilities. If there’s a reliable index, they can price the risk. Claims are simple because the product is parametric: if the price dips, Stable automatically pays.

As investors, we get really excited about comprehensive solutions to huge problems. We’re proud to support Stable as they offer a solution to the twin challenges of food security and price stabilisation.