Topics:

Amplify

It is extremely satisfying to back dynamic teams building high-growth businesses, which is precisely why we invested in Amplify‘s Series A, alongside Greycroft and Crosslink Capital, less than a year after leading their Seed round.

Amplify is exactly the kind of mission-driven financial services company we seek to back at Anthemis. Unlike many other complex financial products previously reserved for high net worth elites, Amplify’s product suite and distribution strategy are designed to democratize access to permanent life insurance and their tax-efficient investment structures, for all Americans.

Permanent life insurance is an awesome proposition. What do we mean by that? Unlike term life insurance, which provides cash for your loved ones in the event of your untimely death, permanent life insurance from Amplify helps you to build health and wealth. Bridging asset management and insurance, permanent life insurance can form a tax-advantaged wrapper for all kinds of investment and financial planning products.

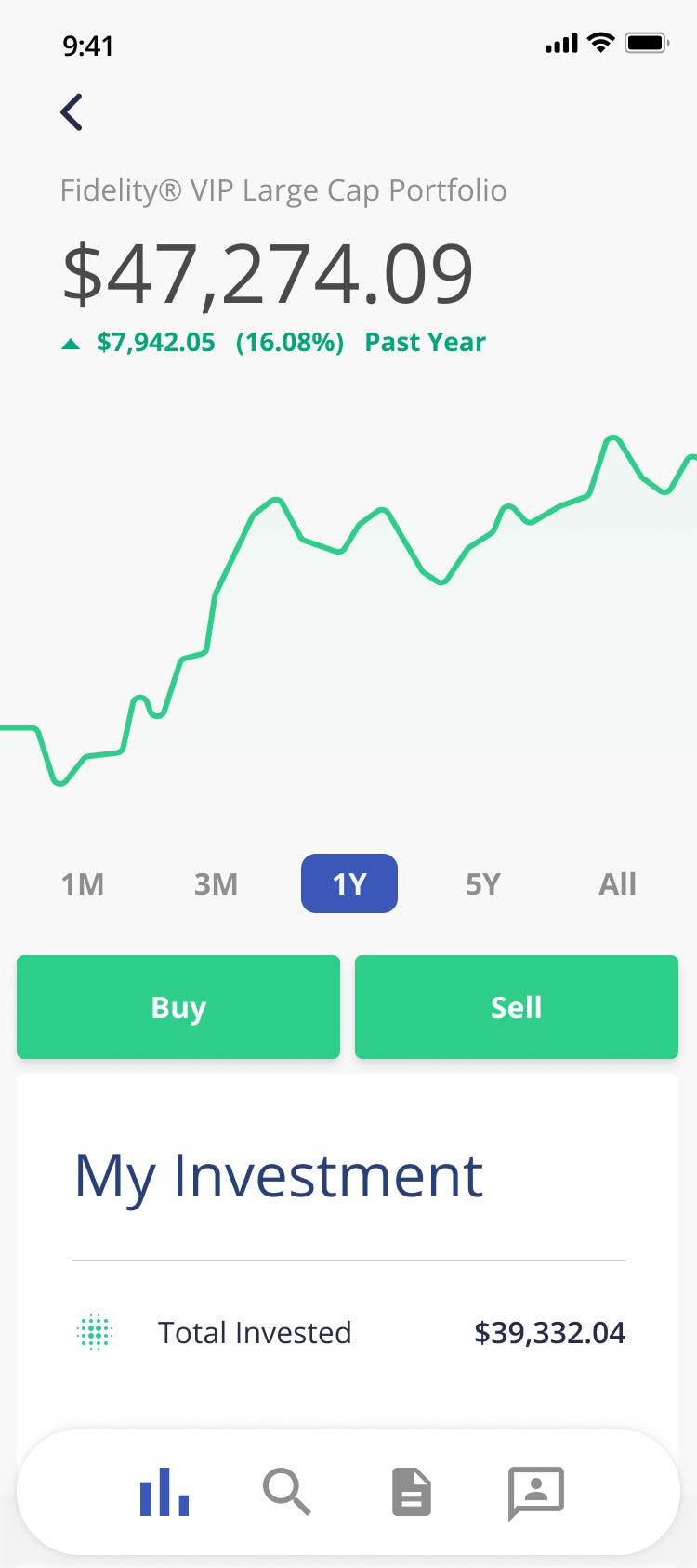

Using Amplify’s engaging platform, customers exit the traditionally transactional industry for a customer-centric and user-friendly approach to their financial needs. A younger generation of consumers, conscious of their long life expectancies and a volatile macro-economic environment, can find suitable products using Amplify. From temporary protection to high-growth, tax-efficient investment products, Amplify offers a suit of solutions adapted to individual needs and budgets.

And the growth potential is enormous. 40% of the adult population know that they are under-insured. Amplify is well poised to serve them: from powerful partnerships, underwriting innovation, product design to financial planning products and services and complementary health and financial wellness, Amplify has an extraordinary roadmap! We’re thrilled to continue to work alongside the whole Amplify team.