Topics:

Amplify

Until recently, disruptive innovation in insurance has largely focused on P&C. Disgusted by negative experiences with the insurance industry, internet entrepreneurs fixed their sights on the clunky purchasing process and miserable claims experience with car and home insurance policies.

2020 represented a step-change: last year, we observed, quarter-on-quarter, the tech community waking up to the opportunities in the Life and Health space, which grew to 30% of global insurtech deal volume by Q3 2020. Life insurance innovation is no surprise. The life and annuities market represents $723.3bn in the US alone.

Early life insurance projects have historically focused on offering term life insurance digitally. And, while term life helps families avoid financial catastrophe in the wake of tragedy, we believe that permanent life insurance is a critical feature of wealth management and planning. Additionally, permanent life insurance product types offering cash savings have been the fastest growing product types in the life insurance market, and permanent life insurance represents $144bn in premiums per year.

We were thrilled to meet Hanna and Qiyun, whose company, Amplify, is all about bringing “wealth and health” through permanent life insurance products to a younger generation of individuals and families.

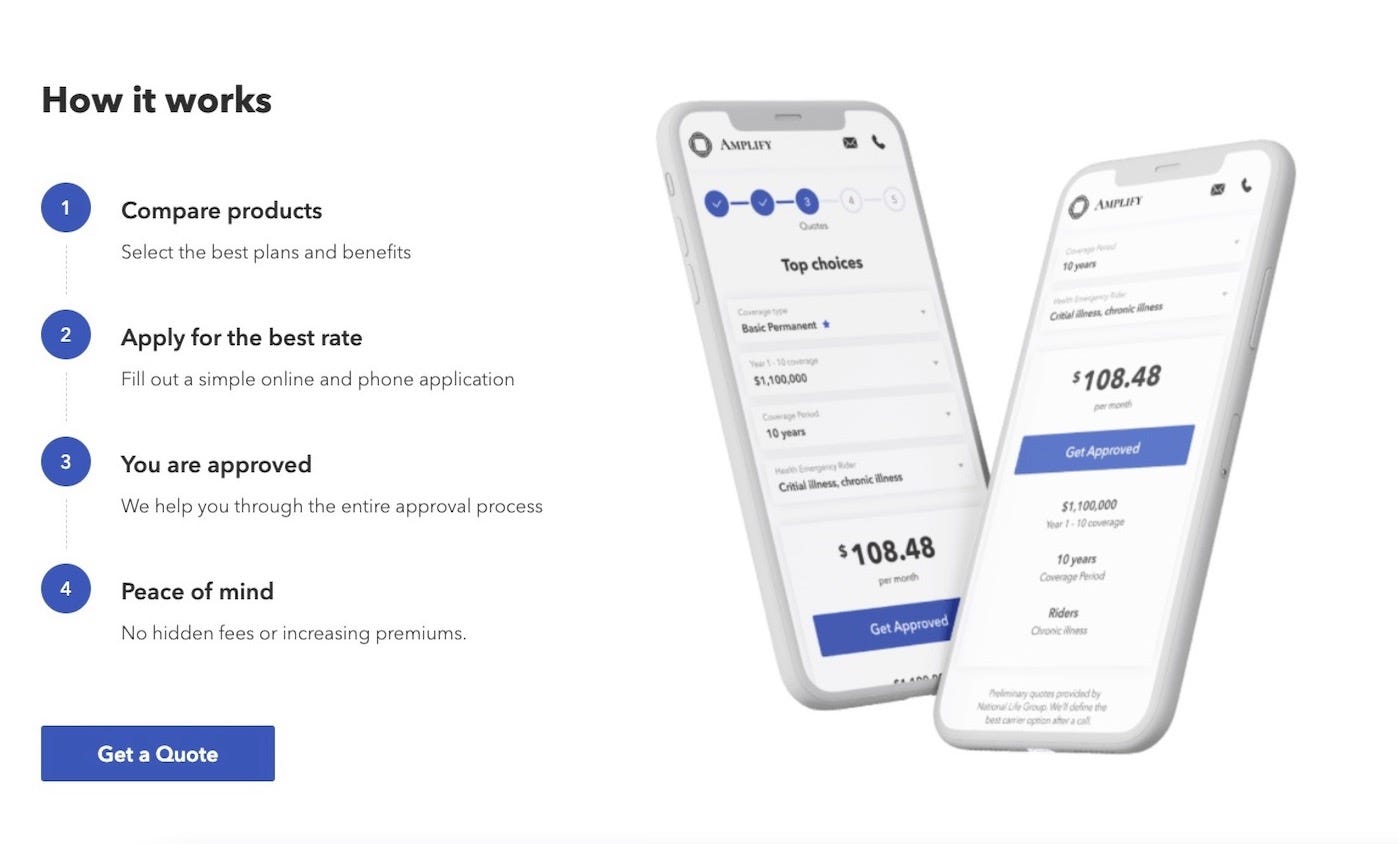

Using a protection-first approach to financial planning for individuals and families, Amplify has stripped out the complexity of traditional permanent life insurance products by offering a simple and intelligent customer journey that provides customized product structuring and basic financial education. Unlike term life insurance products, Amplify is democratizing access to tax-efficient VUL and IUL products, complex financial instruments designed to allow younger people to achieve their long-term financial goals with the added benefit of protecting their families.

Amplify is a digital permanent life insurance platform focused on consumer choice and transparency for Gen X and millennial markets.

Permanent life insurance delivered via Amplify is so exciting (to me both as an investor and as a customer!) because these complex, tax-efficient products provide customers value on their financial journeys throughout their entire life. Additionally, while these products and the purchasing process is traditionally manual and time consuming for customers with traditional insurance providers, Amplify brings customers simplified products digitally to bring convenience, transparency, and customization to users who desire more financial security.

Since our investment earlier this year, the team has accelerated its growth. Amplify is now present and selling policies in all 50 U.S. states, representing the majority of the US market with their focus on millennial and Gen X generations. Amplify is ready to address your family savings and retirement needs…get in touch!