Topics:

Flock

The drone insurance market is one of those rare areas within the insurance industry experiencing phenomenal growth right now, and we’re excited to be a part of it. The number of drone-related patents, drone pilot licenses and drone sales continue to rise, and we believe that innovation in this market is here to stay! That’s why we’re delighted to have led Flock’s recent £2.25m Seed investment round.

Real-time risk analytics… in insurance?

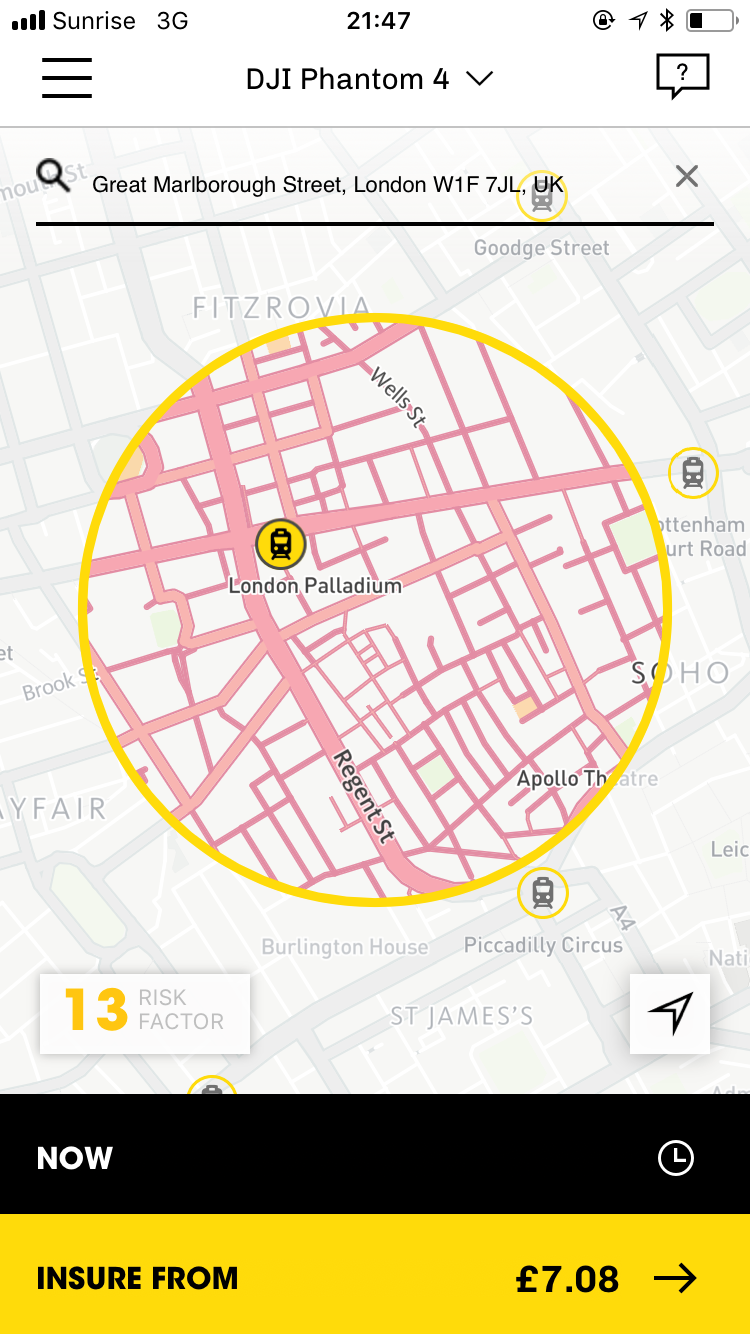

Flock’s platform aggregates and analyses real-time environmental data to quantify and minimise drone flight risk. Flock’s first product, Flock Cover, is a drone insurance proposition, innovative in its delivery (pay-as-you-fly) and, more importantly, in its underwriting approach (creating a real-time risk score).

Flock’s risk intelligence platform unlocks hyper-localised, short-term insurance policies for pilots, starting from one hour in length and from just £5. Pilots can customise their policies to suit their needs; they cover recreational and commercial flights, for a range of liability coverage (£1–10m) with optional add-ons such as equipment cover.

Flock’s app provides pilots with a comprehensive safety tool, alerting them to ground hazards, real-time weather updates, restricted airspace alerts and nearby aviation activity. All of this contributes to reduced claims and more competitive premiums for customers.

Making the world safer

In looking at the market for drone insurance, we saw that drones are increasingly being used for tedious or dangerous tasks. Drones have the potential to solve problems in a wide variety of industries, and can play a vital role in improving safety amongst workers as well as significantly reducing costs of operation for all types of businesses.

Right now, hobbyists account for the majority of drone owners, yet they remain largely unregulated in many countries. Insurers have, perhaps predictably, already seen loss activity resulting from novice control of drones. On the commercial side, the most popular use case is inspections (as drones become more embedded into working practices, we expect workers’ compensation losses to reduce), aerial photography and agriculture. In truth, we also can’t help but get excited about pizza delivery by drones and getting our books within 30 minutes.

In the aftermath of more recent natural catastrophes, insurers have been using drones to survey loss damage, enabling them to quickly understand their exposure and to provide better service to customers already in distress. We’re also seeing the emergence of mini-industries on the periphery, such as third-party on-demand ‘drone for hire’ vendors.

A dynamic team for a dynamic market

At the helm of the Flock team are two talented scientists and technologists, Antton Peña and Ed Leon Klinger. The way in which the team designed and executed on their product roadmap, as well as their engagement with insurers, really stood out for us when we met last summer. Their long-term vision, leveraging their real-time risk analytics platform, is truly impressive. We’re thrilled to be working with everyone at

Flock to make that vision a reality, and to be working with Roger McCorriston, Chairman at Aioi Nissay Dowa Insurance Europe, who is also joining the board. If you’re up for the challenge, Flock is hiring.

Last (but definitely not least) I’d also like to take this opportunity to thank Robin Merttens at InsTech London, who made the initial introduction. Robin does so much for the wider insurance community, so thank you!