Topics:

Flock

Our first investment in Flock was one of the first that I championed not long after I made the jump from reinsurance to venture capital. I still remember my first few interactions with Ed and Antton – they demonstrated a mastery of both insurance and product. They could tell a damn good story, too.

Today, three short years later, the team is announcing a $17m Series A raise, led by Social Capital. It’s an exciting moment for the company and the team, and a great opportunity to look back on how things have been since our first involvement.

Back in 2018, I wrote about that first investment and described the core part of our investment thesis – namely, that in the context of drone-related patents, drone pilot licenses and drone sales continuing to rise, Flock had an opportunity to build the dominant drone insurance provider in the UK market. We’re pleased to say that we believe Flock did that, having attained a hefty chunk of this exciting market and with a consistently market-beating loss ratio.

What we knew at the time was that Flock undoubtedly had something special when it came to technology: to this day, their platform aggregates and analyses real-time environmental data to quantify and minimise drone flight risk. In turn, Flock unlocked something that had eluded many traditional insurers: hyper-localised, short-term insurance policies for pilots, starting from one hour in length – and from just £5! Shortly after this followed policies for commercial use, and then insurance for fleets of commercial drones.

It always seemed clear to us that drone usage would continue to increase, especially for tedious and dangerous tasks. However, what was still to land on was where the company would apply its technology and talents next. As we wrote in our Investment Committee paper at the time, “due to the modular design of Flock’s algorithms, many components are applicable to a variety of situations […] the architecture of the algorithms is a generalised system for predicting loss based on geospatial information […] applicable algorithm modules and the architecture of the algorithms can most certainly be expanded to apply to other technologies such as cars…”

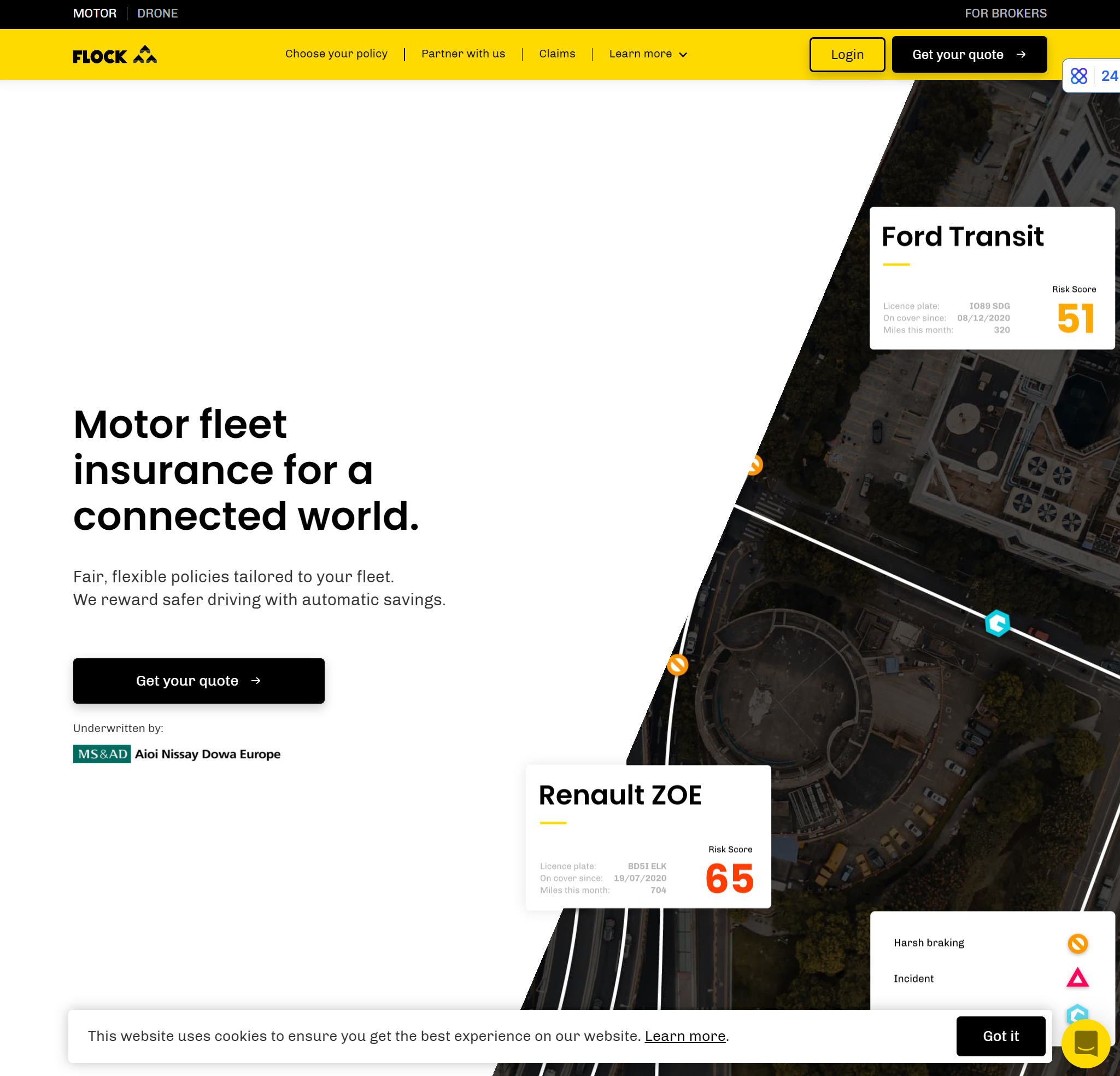

Fast forward to 2020, after some extensive and impressive strategy and research work, we were proud that the team launched their flexible connected motor insurance product, Flock Motor, for self-drive hire, own goods, courier and tradesperson fleets in the UK. Inspired by – and building upon their initial success in – drone insurance, Flock now offers an innovative insurance product for modern fleets that change on a regular basis. In short: flexible products and fairer pricing, as well as insights for fleet managers.

Shortly after their launch, the team announced that they now covered The Out, Jaguar Land Rover’s premium car rental service, and had partnered with Engineius, a UK-based end-to-end vehicle movement solution. In June 2021, the company also announced that they had partnered with the European arm of Asia’s largest insurer, Aioi Nissay Dowa Insurance (AND-E UK). In addition to this exciting growth, the team has expanded with the addition of considerable motor insurance expertise.

When you stop to think about the technologies of the future, many of us immediately go to things like autonomous vehicles, flying cars and drones. However, the fact that all of these also require insurance is probably much less likely to be one of your first thoughts. Unless you’re me or Anthemis. But it’s true, and it’s an exciting opportunity. Flock’s mission to make the world a safer, smarter place is just getting started. We’re very much looking forward to this exciting new phase, as Dig Ventures continues the journey and as the Social Capital team joins this exciting ride.